When occupied with cobranded airline playing cards, it is easy to solely take into consideration the playing cards from airways you regularly fly with. In spite of everything, among the key advantages of airline playing cards embody precedence boarding, free checked baggage and a sooner path to elite standing with the affiliated airline.

I typically encourage folks to assume past a card’s airline or resort accomplice when deciding whether or not it is smart for them.

Take the Citi® / AAdvantage® Govt World Elite Mastercard® (see charges and charges), for instance. This card offers a complimentary Admirals Membership membership to assist cardholders justify its $595 annual price. On the floor, it looks as if that might solely be helpful for American Airways’ largest followers.

However an Admirals Membership membership gives one thing further: complimentary entry to Alaska Airways lounges. Here is how Alaska loyalists can maximize this card with out ever setting foot on an American Airways flight.

Alaska Airways lounge entry

By means of the Admirals Membership membership you obtain along with your AAdvantage Govt, you will take pleasure in complimentary entry to Alaska lounges everytime you’re flying on a same-day American, Alaska or Hawaiian Airways flight. Word that this entry is not prolonged to approved customers, and you have to have your bodily card with you to enter.

An ordinary Alaska Airways lounge membership prices $595 a 12 months, the identical as this card’s annual price. By placing that cash towards the AAdvantage Govt as a substitute of a lounge membership, you will take pleasure in Alaska lounge entry plus all of this card’s different advantages.

No matter whether or not you are flying with American, Alaska or a Oneworld airline, it’s also possible to get into Admirals Membership lounges for no added price.

To entry accomplice lounges with simply an Alaska Airways lounge membership, you’d need to pay $795 every year for the Alaska Lounge+ membership, $200 greater than what the AAdvantage Govt expenses.

Whereas an Alaska Lounge+ membership offers entry to a couple lounges that the AAdvantage Govt does not, corresponding to three United Golf equipment, nearly all of its accomplice lounges overlap with what you may entry with this card.

Each day E-newsletter

Reward your inbox with the TPG Each day publication

Be part of over 700,000 readers for breaking information, in-depth guides and unique offers from TPG’s consultants

Each an Alaska Lounge+ membership and the AAdvantage Govt present entry to The Qantas Membership and Admirals Membership places. I see no purpose to pay $200 extra every year for a sliver of additional lounges to entry.

You’ll be able to e book Alaska Airways flights with American Airways miles

The AAdvantage Govt earns American Airways miles. Whereas that may initially appear ineffective to an Alaska loyalist, it is really the other.

American Airways miles can simply be used to e book Alaska Airways flights, which means chances are you’ll by no means even need to step on American Airways metallic to get extra worth out of this card past lounge entry. That mentioned, there are some nice itineraries that mix Alaska and American Airways flights.

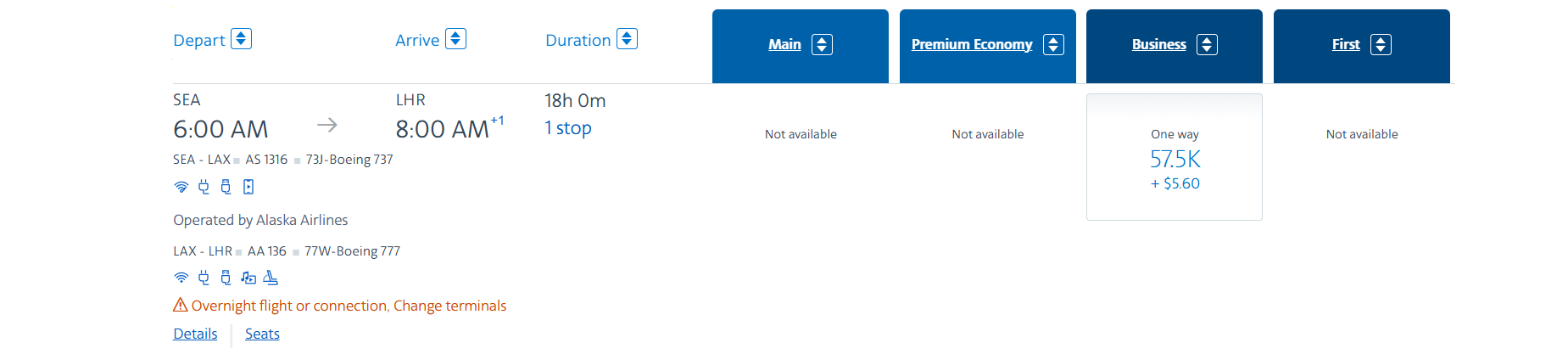

For instance, you would e book a one-way business-class ticket from Seattle-Tacoma Worldwide Airport (SEA) to Heathrow Airport (LHR) for 57,500 miles plus $5.60 in taxes and charges. In the event you had been to e book this itinerary with money, you’d pay $3,483. That is a worth of 6 cents per level.

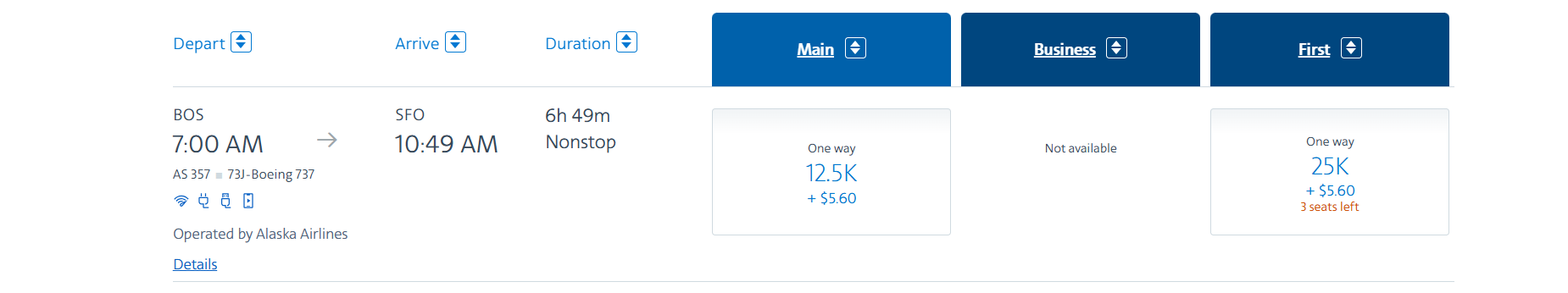

In the event you typically fly domestically, there’s loads of availability there, too. You could possibly e book a nonstop financial system flight on Alaska through American from Boston Logan Worldwide Airport (BOS) to San Francisco Worldwide Airport (SFO) for 12,500 miles plus $5.60 in taxes and charges.

In the event you had been to e book with money, this flight would value $304, netting you 2.4 cents per level in worth. That is nice for a home financial system flight.

To study extra about what American Airways miles are price, take a look at our full information to the AAdvantage program.

Learn how to earn American Airways miles

For a restricted time, you may earn 100,000 bonus miles after spending $10,000 within the first three months from account opening with the AAdvantage Govt. That is a ton of miles to make use of towards Alaska flights, and even an American flight or two when you discover an important deal.

Except for its welcome bonus, this card gives easy incomes charges that can assist you rack up extra American miles. You will earn 10 miles per greenback spent on accommodations booked by aadvantagehotels.com and automotive leases booked by aadvantagecars.com. Plus, you may earn 4 miles per greenback spent on different American Airways purchases and 1 mile per greenback spent on the whole lot else.

In the event you spend $150,000 a 12 months or extra on this card, you will earn 5 miles per greenback spent on American Airways purchases as a substitute of 4 by the tip of the calendar 12 months.

Whereas I typically do not advocate utilizing this card for non-American Airways purchases, if incomes miles towards award flights on Alaska is on the high of your precedence listing, it might make sense to tug this card out for sure purchases. That is very true when you’re making a purchase order that does not fall beneath a bonus class coated by one in every of your different playing cards.

Associated: How I exploit Seats.aero each day to seek out the perfect airline award availability in seconds

Different helpful advantages

Regardless of being an American Airways-branded card, the AAdvantage Govt has further advantages you should use with out reserving a flight.

In the event you typically lease automobiles in your holidays, you will take pleasure in this card’s rental automotive assertion credit score. You’ll be able to earn as much as $120 again yearly on eligible pay as you go leases from Avis or Price range. Simply remember the fact that you will need to e book your rental on-line to obtain the credit score.

If renting a automotive is not one thing you normally do, this card can nonetheless assist offset your transportation prices. You’ll be able to obtain as much as $120 again every year for Lyft rides. It’s important to take three rides to obtain your $10 month-to-month credit score, so this profit is finest for individuals who naturally use Lyft a number of occasions a month.

Lastly, you may obtain as much as $10 every billing assertion for Grubhub purchases. That is nice for anybody who likes to order takeout, even simply now and again. To make your credit score stretch additional, order pickup as a substitute of supply.

Whereas these credit are lifestyle-dependent, they will nonetheless present outsize worth for anybody who can simply benefit from them.

A straightforward credit score for any traveler to make use of is that this card’s TSA PreCheck/World Entry utility price credit score. Even when you have already got TSA PreCheck or World Entry, you should use your AAdvantage Govt to pay for another person’s utility.

Lastly, this card gives a variety of vital journey protections. You do not have to fly with American Airways to make use of these protections, to allow them to assist safeguard your subsequent flight with Alaska. Journey cancellation and interruption safety, misplaced baggage insurance coverage, and journey delay safety are a number of vital advantages you could depend on.

Backside line

To get Alaska lounge entry with a regular membership, you’d need to pay $595 a 12 months. For a similar worth, you will get Alaska, Admirals Membership and Qantas lounge entry; American Airways miles to make use of for Alaska flights; assertion credit; and journey protections with the AAdvantage Govt.

It is a no-brainer for any Alaska loyalist to significantly contemplate making use of for the AAdvantage Govt. It is a good way to supercharge your subsequent Alaska flight, particularly because it’s presently providing an elevated 100,000-mile welcome bonus. Plus, when you’re ever inquisitive about making an attempt American Airways, this card is prepared in your pockets that can assist you out.

To study extra, take a look at our full evaluate of the Citi / AAdvantage Govt.

Apply right here: Citi / AAdvantage Govt World Elite Mastercard