Unhealthy information for followers of factors and miles: Some U.S. senators are attempting to push the Credit score Card Competitors Act as a “poison capsule” modification in pending laws that is up for a vote in Congress.

Sen. Roger Marshall, a Republican from Kansas, filed an modification final week on behalf of himself and Sen. Dick Durbin, a Democrat from Illinois, so as to add the CCCA to the Guiding and Establishing Nationwide Innovation in U.S. Stablecoins Act.

The GENIUS Act has acquired bipartisan assist, and initially, it appeared prone to move the Senate with greater than the important thing threshold of 60 votes. Proponents of the laws declare it might permit for higher regulation of the cryptocurrency market and supply extra stability in digital forex markets total.

Senate Majority Chief John Thune is permitting amendments to the invoice, which opens up the opportunity of the CCCA getting connected to the invoice if senators vote to approve the addition. Nonetheless, a minimum of one senator has mentioned he’ll withdraw his earlier assist for the GENIUS Act if the CCCA does find yourself being connected.

“If it had been to be adopted in GENIUS, I might withdraw my assist on the Senate ground,” mentioned Sen. Thom Tillis, a Republican from North Carolina, in keeping with the Washington Reporter.

And several other different senators are calling for a “clear” GENIUS Act vote with out amendments.

They embrace Senator Cynthia Lummis, a Republican from Wyoming and Senator Invoice Hagerty, a Republican from Tennessee.

Vice President JD Vance can also be demanding a “clear” vote with out the CCCA connected laws.

Sadly, if Marshall and Durbin are profitable and the Senate votes to approve the modification, the CCCA might be added to the invoice. This may drive senators to decide on between voting towards in any other case fashionable laws to keep away from passage of the controversial modification or permitting the complete invoice to move and coping with the CCCA’s penalties.

Day by day E-newsletter

Reward your inbox with the TPG Day by day e-newsletter

Be part of over 700,000 readers for breaking information, in-depth guides and unique offers from TPG’s consultants

Inform Congress not to remove your bank card rewards: Shield Your Factors

“This can be a political favor to [the bill’s] supporters’ largest marketing campaign donors,” mentioned Richard Hunt, govt chairman of the Digital Funds Coalition.

The Digital Funds Coalition is a commerce affiliation representing credit score unions, group banks and cost card networks.

“This invoice has by no means been by way of a related committee, by no means been debated, and was by no means even reintroduced this Congress,” Hunt mentioned. “Not like the sponsors of the GENIUS Act, the sponsors of Durbin-Marshall [the Credit Card Competition Act] haven’t performed their due diligence.”

TPG is strongly against the CCCA as a result of we consider it might destroy the consumer-friendly advantages of bank cards.

What’s the Credit score Card Competitors Act?

The CCCA places value controls on interchange charges and will nearly get rid of the profitable sign-up bonuses and points-earning capability for a lot of financial institution, airline and resort bank cards.

When related laws was handed on debit playing cards in 2010, shoppers had been promised decrease costs on items and companies as a result of smaller debit card transaction charges could be handed on to shoppers within the type of decrease costs. That did not occur. As a substitute, points-earning and sign-up bonuses on these playing cards disappeared, and costs elevated.

A research by the Worldwide Middle for Legislation and Economics estimated that the cap on interchange charges for debit transactions hit massive banks’ annual revenues to the tune of $6.6 to $8 billion. This loss in income immediately contributed to the discount in free checking accounts and rewards applications.

The Electronics Funds Coalition advised TPG that “the Durbin-Marshall invoice lets company mega-stores like Walmart, Goal and Residence Depot select the most affordable bank card processing choice — with out contemplating shopper safety or advantages.”

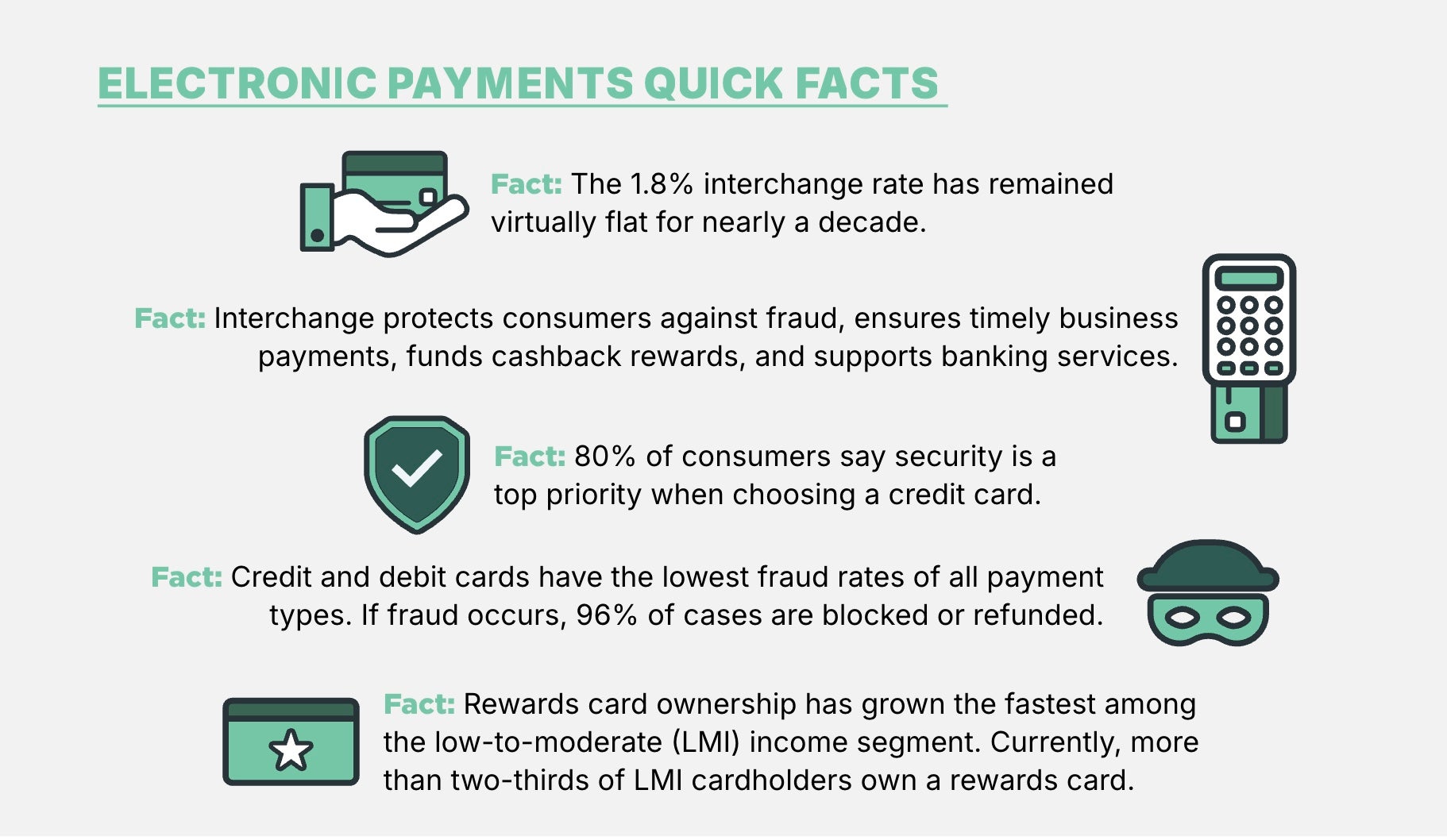

The Digital Funds Coalition additionally factors out:

- This invoice might drive transactions onto unproven networks, weakening fraud protections and elevating prices for companies and shoppers.

- It threatens bank card rewards, together with money again advantages that assist shoppers battle inflation and profit small companies.

- Small companies might face increased prices and fewer advantages from accepting card funds.

Analysis exhibits that this invoice might additionally trigger an financial slowdown for the U.S., costing $227 billion in misplaced financial exercise and roughly 156,000 in misplaced jobs.

A College of Miami research discovered that the CCCA would considerably cut back income for group banks and credit score unions whereas additionally curbing entry to credit score and banking companies in smaller markets throughout the nation, disproportionately affecting rural and low-income households.

As an organization based partly on the precept of utilizing bank card rewards applications to assist get monetary savings on journey, TPG is among the many many organizations with a vested curiosity on this trigger.

A various and wide-ranging set of organizations and industries, together with labor unions, small-business house owners, monetary establishments (comparable to credit score unions and group banks) throughout all 50 states, coverage institutes, commerce associations, suppose tanks and airways, strongly oppose the laws.

How you can assist defend Your factors

Whereas we do associate with main bank card issuers at TPG, our employees members and hundreds of thousands of our readers have seen firsthand how rewards applications can unlock journey that will be in any other case out of attain. By making journey extra accessible, we assist our readers broaden their horizons, open their minds and expertise totally different cultures — all of which might be jeopardized if the CCCA had been allowed to move as an modification to the GENIUS Act.

“This may be disastrous for shoppers,” TPG founder Brian Kelly mentioned. “… [They] would lose out on rewards, buy protections and fraud protections, whereas retailers would add to their backside line.”

In partnership with the Digital Funds Coalition, TPG has launched Shield Your Factors, an advocacy platform for TPG readers to specific opposition to the invoice to their native representatives and senators.

Click on on this hyperlink to submit a fast kind. Please take 30 seconds at present to inform your senator to vote towards the CCCA modification to the GENIUS Act.

Associated studying: