The Platinum Card® from American Specific and The Enterprise Platinum Card® from American Specific have established themselves because the playing cards to have in case you’re fascinated with luxurious journey advantages. With an overlapping rewards construction and related advantages, it is logical to query which of the 2 is one of the best for you. Or, if you have already got one of many playing cards, it’s possible you’ll be questioning whether or not you also needs to go for the opposite.

It might really work out in your favor to make room for each playing cards in your pockets — even with the $695 annual charges on every (see charges and charges for the Amex Platinum and charges and charges for the Amex Enterprise Platinum).

Every card has advantages to enrich the opposite and vacationers can have no drawback incomes again the steep yearly charges, making them an amazing mixture in the case of getting probably the most out of your journeys.

This is why it’s your decision each in your pockets.

Unbelievable welcome provide worth

Each playing cards include fairly substantial welcome affords. Proper now, new Enterprise Platinum Card cardmembers can earn 150,000 bonus factors after spending $20,000 within the first three months of cardmembership.

With the Amex Platinum, new cardmembers can earn 80,000 bonus factors after spending $8,000 within the first six months of cardmembership (though it’s possible you’ll be focused for the next provide by way of the CardMatch Software — topic to alter at any time and never everybody will probably be focused for a similar affords).

In the event you apply for each playing cards and earn the total welcome bonuses, you may get at the very least 230,000 Membership Rewards factors. Primarily based on TPG’s March 2025 valuations, that is value $4,600— greater than triple the mixed price of the annual charges.

Associated: Is the Amex Enterprise Platinum well worth the annual charge?

Card credit

Each playing cards have numerous credit to assist cardmembers get worth yr after yr. Enrollment is required for choose advantages; phrases apply.

Each day Publication

Reward your inbox with the TPG Each day publication

Be a part of over 700,000 readers for breaking information, in-depth guides and unique offers from TPG’s consultants

Sometimes, one of many best perks to make the most of with the Platinum playing cards is the annual airline charge assertion credit score you may obtain every calendar yr.

Every card has an up-to-$200 annual airline charge assertion credit score every calendar yr (enrollment required). Whereas it is not as beneficiant because the $300 annual journey credit score you may get with the Chase Sapphire Reserve® (which may be utilized to any journey buy), the credit score with the Amex Platinum playing cards remains to be very helpful.

On prime of the airline charge credit, the private Platinum card is loaded with annual affords. Cardmembers get pleasure from the next (some advantages require enrollment):

In the case of annual assertion credit, the Enterprise Platinum isn’t any slouch, both. It affords as much as $400 in Dell assertion credit every calendar yr (as much as $200 semi-annually), as much as $360 in assertion credit for Certainly per calendar yr (as much as $90 every quarter), as much as $200 per calendar yr in Hilton assertion credit (as much as $50 per quarter), as much as $150 every calendar yr in Adobe assertion credit (topic to auto-renewal) and as much as $120 per calendar yr in assertion credit for purchases with U.S. wi-fi cellphone suppliers (as much as $10 per thirty days). The Dell and Adobe credit will finish on June. 30.

The Enterprise Platinum additionally matches the non-public Platinum in providing assertion credit for each Clear Plus and your International Entry or TSA PreCheck utility charge (which you should use to pay for a frequent journey companion’s utility). These credit are value the identical because the Amex Platinum’s, and are issued in the identical timeframe.

Enrollment is required for choose advantages; phrases apply.

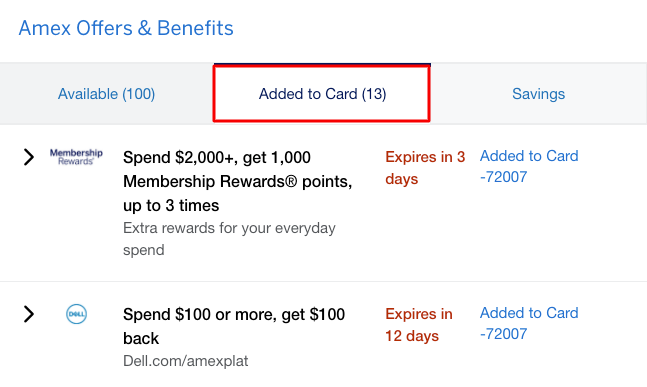

Amex Presents

All American Specific playing cards, together with the Platinum and Enterprise Platinum playing cards, include entry to Amex Presents. You will discover your obtainable affords in case you scroll right down to “Amex Presents & Advantages” in your on-line account web page or click on on the “Presents” tab on the Amex app. They’re focused to every cardmember and are available from retailers together with inns, journey suppliers, eating places and clothes and jewellery shops. These affords are normally both:

- Spend $X, get Y variety of bonus factors.

- Spend $X, get $Y again.

- Get further factors for every greenback you spend at a choose service provider.

Whereas Amex Presents is usually a nice deal alone, you are able to do even higher once you stack them with on-line procuring portals to earn additional money again or bonus factors in your buy.

Be warned: Relying on the phrases of the provide, utilizing on-line portals, promo codes or different financial savings strategies might trigger your Amex Provide to not set off, so all the time learn the nice print within the phrases.

That mentioned, the excellent news is you can stack the highest Amex Presents with different standard Amex perks, together with a number of the annual assertion credit that include the Platinum and the Enterprise Platinum playing cards. Eligibility for these affords is restricted. Enrollment is required within the Amex Presents part of your account earlier than redeeming.

Associated: Your final information to Amex Presents

Journey advantages

Cardmembers have entry to a wide range of insurance coverage insurance policies when reserving journey and going procuring with their card, together with:

- Journey cancellation and interruption insurance coverage*

- Journey delay insurance coverage*

- Cellphone safety*

- Baggage insurance coverage**

- Buy safety**

- Return safety**

- Prolonged guarantee**

*Eligibility and profit stage varies by card. Phrases, circumstances and limitations apply. Go to americanexpress.com/benefitsguide for particulars. Insurance policies are underwritten by New Hampshire Insurance coverage Firm, an AIG Firm.

**Eligibility and profit ranges range by card. Phrases, circumstances and limitations apply. Go to americanexpress.com/benefitsguide for particulars. Insurance policies are underwritten by AMEX Assurance Firm.

Some playing cards have eradicated these protections over the previous few years, so these advantages present another excuse to e book your journey with an Amex Platinum.

The Platinum playing cards not solely defend you from a number of journey disasters however can even improve your journey expertise.

The Platinum playing cards get you entry to The International Lounge Assortment, giving cardmembers free entry into any Amex Centurion Lounge plus entry to numerous further airport lounges as effectively. Entry is restricted to eligible cardmembers. Total, the gathering grants entry to over 1,400 VIP lounge areas throughout 140 nations — a really beneficial profit.

Absolutely to be sought out by frequent flyers, the Platinum playing cards additionally present some supplemental advantages to make travels a bit simpler: Platinum Journey Service counselors may also help set an itinerary to benefit from your journeys, whereas International Eating Entry by Resy can get you into your most desired eating places. Most popular Entry is even a option to snag unique seats at cultural and sporting occasions.

Enrollment is required for choose advantages; phrases apply.

Resort advantages

One space the place these two playing cards overlap is entry to an array of resort advantages. With each the non-public and enterprise Amex Platinum, you may obtain complimentary Gold standing at Hilton and Marriott and have entry to Amex Wonderful Motels + Resorts. Enrollment is required for choose advantages; phrases apply.

Gold standing at Hilton comes with perks like complimentary breakfast, room upgrades when obtainable and an 80% level bonus on paid stays. Marriott Bonvoy Gold standing comes with advantages equivalent to precedence late checkout, upgrades when obtainable and a 25% level bonus.

Amex Wonderful Motels + Resorts is a program that provides elitelike advantages at properties around the globe. These perks embody assured late checkout, each day breakfast for 2, room upgrades when obtainable and a novel property amenity (valued at $100 or extra).

Some properties on this program may also provide third, fourth or fifth nights free, which is a beneficial profit once you’re not trying to make use of your resort factors for a keep.

When you solely want one Platinum card to get pleasure from these advantages, having each ensures you are making the most of advantages whereas maximizing incomes, whether or not your journey is for enterprise or pleasure.

Maximizing private and enterprise spending

Maybe one of many largest advantages of getting each the non-public and enterprise variations of the Amex Platinum is you can successfully earn 7.7% again on each airfare buy you set in your private Platinum Card (airfare booked instantly with the airline or by way of American Specific Journey earns 5 factors per greenback on as much as $500,000 spent on these purchases per calendar yr; 1 level per greenback thereafter). This incomes charge additionally holds true for pay as you go inns booked by way of Amex Journey.

It’s because, when you’ve got the Enterprise Platinum Card, you’ve got the flexibility to Pay with Factors to e book flights with Amex Journey, and doing so will get you 35% of your factors again (as much as 1 million factors per calendar yr). This primarily will get you a price of 1.54 cents per level.

In the event you earn 5 factors per greenback on eligible journey purchases after which redeem these factors at a price of 1.54 cents, you are getting a return of seven.7%.

That mentioned, in case you maximize American Specific’s array of beneficial switch companions, you might be able to get much more worth. In spite of everything, TPG values Amex Membership Rewards factors at 2 cents apiece as of our March 2025 valuations.

One thing else to contemplate is that the Amex Enterprise Platinum earns 1.5 factors per greenback on U.S. building materials and {hardware} purchases, U.S. electronics, cloud system suppliers and software program purchases and U.S. transport suppliers. To prime it off, the Enterprise Platinum additionally earns 1.5 factors per greenback on purchases of $5,000 or extra. Purchases that earn 1.5 factors per greenback are restricted to the primary $2 million each calendar yr (1 level per greenback thereafter).

Say, for instance, you are making an $11,500 buy, and also you would not be eligible for a bonus with one other card. In whole, you’d earn 17,250 Membership Rewards factors on the Enterprise Platinum card — value about $345 based mostly on TPG’s valuations.

In the event you have been to make use of one other eligible Amex card and not using a class bonus for what you are shopping for, you’d earn 11,500 Membership Rewards factors — value about $230.

Successfully, you would be getting greater than $100 additional in worth by utilizing the Enterprise Platinum.

Associated: The right way to maximize your incomes with the Amex Enterprise Platinum

Backside line

Utilizing each the non-public Amex Platinum Card and the Enterprise Platinum Card can get you the utmost worth on each your rewards-earning and redemptions, along with some nice cardmember perks.

The combo is ideal for business-owning vacationers who’ve a excessive funds and need to make the most of large financial savings, beneficiant credit and opulent journey alternatives.

Though the annual prices are excessive, the appropriate cardmembers can have no concern getting huge worth out of this pairing. Every is a superb card by itself, however having each in your pockets can get you much more Membership Rewards factors and assist you to stretch these factors additional when it comes time to make use of them for journey.

To study extra, learn our full evaluations of the Amex Platinum and Amex Enterprise Platinum.

Apply right here: Amex Platinum

Apply right here: Amex Enterprise Platinum

For charges and charges of the Amex Platinum card, click on right here.

For charges and charges of the Amex Enterprise Platinum card, click on right here.