In the event you really need to maximize your factors and miles, periodic switch bonuses can supply profitable alternatives for implausible award redemptions. You may typically get considerably extra worth out of your rewards by transferring them to a selected airline or lodge associate throughout certainly one of these bonuses.

Nonetheless, these are limited-time provides — so act quick for those who discover one which fits your journey plans.

We have compiled switch bonus updates for many main applications with transferable rewards to make monitoring these provides simpler. Simply observe that switch bonuses are typically focused, so some might not be accessible.

American Categorical Membership Rewards switch bonus

There’s at the moment a switch bonus working for American Categorical Membership Rewards: Avianca LifeMiles members who switch American Categorical Membership Rewards factors to LifeMiles this month can get 15% extra LifeMiles.

Since LifeMiles is providing this bonus, you will not be focused in your American Categorical account; quite, you will discover it once you log into your LifeMiles account, as proven under.

Per the acknowledged phrases and circumstances, members should switch a minimal of 1,000 Membership Rewards factors between Feb. 1 and Feb. 28 for a further 15% LifeMiles, which ought to seem of their account inside 72 hours.

How you can earn American Categorical Membership Rewards factors

In the event you’re trying to earn extra of those worthwhile factors, the next Amex playing cards might show helpful additions to your pockets:

Examine the CardMatch software to see for those who’re focused for a fair increased welcome supply (topic to vary at any time).

Day by day E-newsletter

Reward your inbox with the TPG Day by day e-newsletter

Be a part of over 700,000 readers for breaking information, in-depth guides and unique offers from TPG’s specialists

You may also earn additional Membership Rewards factors once you enroll in Amex Provides and store with Rakuten.

Based mostly on TPG’s February 2025 valuations, Membership Rewards factors are price 2 cents every, and our checks point out that they switch immediately to most of Amex’s switch companions.

Associated: How you can redeem American Categorical Membership Rewards factors for optimum worth

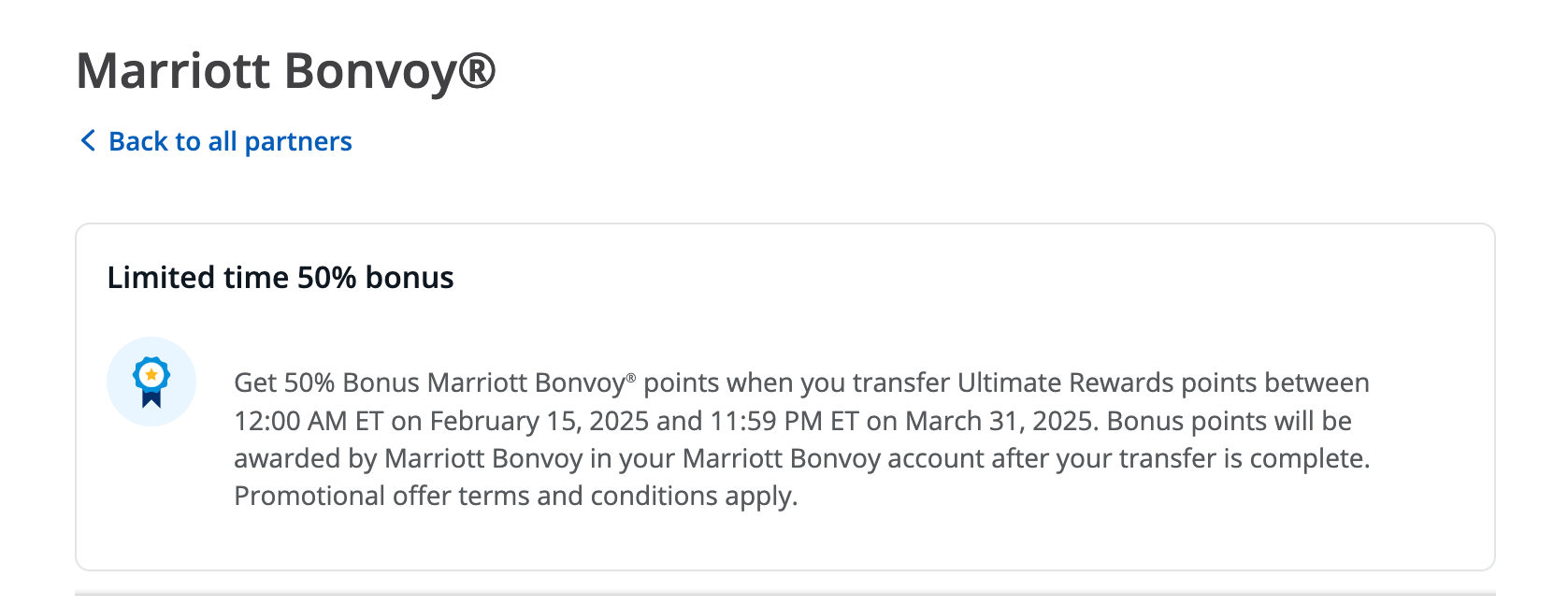

Chase Final Rewards switch bonus

Chase Final Rewards is at the moment providing to switch bonuses:

- Virgin Atlantic Flying Membership members can earn a 30% bonus when changing Chase factors into Virgin factors. So, for instance, transferring 1,000 Final Rewards factors would yield 1,300 Virgin factors via this promo. U.S.-based Virgin Atlantic Flying Membership members are eligible for this promotion from Feb. 3-17. You may redeem Virgin factors for flights, lodge stays, cruises and experiences via Virgin Purple and Flying Membership.

- There’s additionally a 50% switch bonus once you switch Chase Final Rewards factors to your Marriott Bonvoy account via 11:59 p.m. EST March 31.

Keep in mind that TPG at the moment values Marriott Bonvoy factors at 0.85 cents and Chase Final Rewards factors at 2.05 cents every, so that is doubtless not the perfect use of your Marriott factors.

How you can earn Chase Final Rewards factors

If you wish to earn extra Chase Final Rewards factors, the next Chase playing cards might make good additions to your pockets:

In case you have one (or extra) of the above playing cards, you may mix your Final Rewards factors in a single account. Then, you may successfully convert the cash-back earnings on the next playing cards into totally transferable Final Rewards factors:

- Chase Freedom Flex®: Earn $200 money again after spending $500 on purchases within the first three months from account opening.

- Chase Freedom Limitless®: Earn a further 1.5% money again on every part you purchase within the first yr (on as much as $20,000 spent), price as much as $300 money again.

- Ink Enterprise Money® Credit score Card: Earn as much as $750 bonus money again — $350 after you spend $3,000 on purchases within the first three months and a further $400 once you spend $6,000 on purchases within the first six months from account opening.

- Ink Enterprise Limitless® Credit score Card: Earn $750 bonus money again after spending $6,000 on purchases within the first three months from account opening.

In accordance with TPG’s February 2025 valuations, Chase Final Rewards factors are price 2.05 cents every when maximized with journey companions. Most Final Rewards transfers will course of immediately.

Associated: How you can redeem Chase Final Rewards factors for optimum worth

Capital One switch bonus

Sadly, Capital One just isn’t providing any switch bonuses in the mean time.

How you can earn Capital One miles

In the event you’re trying to earn extra transferable miles, the next Capital One playing cards are stable choices to think about:

TPG’s February 2025 valuations peg Capital One miles at 1.85 cents apiece, and most transfers from Capital One will course of immediately.

For extra particulars, take a look at our guides to the Capital One switch companions and find out how to switch Capital One miles to airline and lodge companions.

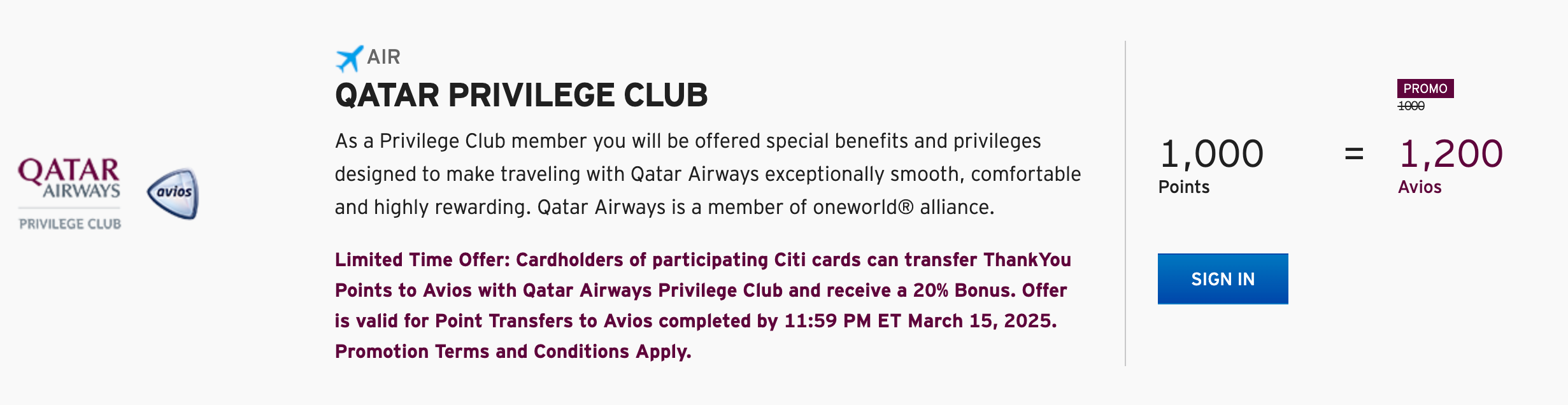

Citi ThankYou Rewards switch bonus

Citi ThankYou Rewards is providing a 20% switch bonus once you switch ThankYou Rewards factors to Qatar Airways Privilege Membership Avios. Qatar Airways is certainly one of 5 airways that makes use of Avios foreign money, particularly:

This implies you may switch Avios between any of the taking part applications at a 1:1 ratio, however the way in which wherein you redeem Avios in every program can change the worth of the factors.

This promotion is legitimate for transfers via 11:59 p.m. EST on March 15. For instance, you would switch 1,000 Citi ThankYou factors for 1,200 Avios.

How you can earn Citi ThankYou Rewards factors

These Citi bank cards might make helpful additions to your pockets for incomes Citi ThankYou Rewards factors:

Marriott Bonvoy switch bonus

Marriott Bonvoy is at the moment not providing any switch bonuses.

How you can earn Marriott Bonvoy factors

In the event you’re trying to earn extra Marriott Bonvoy factors, the next Marriott Bonvoy playing cards could also be of curiosity:

- Marriott Bonvoy Sensible® American Categorical® Card: Earn 95,000 Marriott Bonvoy bonus factors after spending $6,000 on purchases inside the first six months of card membership.

- Marriott Bonvoy Boundless® Credit score Card: Earn a $150 assertion credit score after making the primary buy within the first 12 months from account opening, and earn 100,000 bonus factors after spending $3,000 on purchases in your first three months from account opening.

- Marriott Bonvoy Enterprise® American Categorical® Card: Earn 125,000 Marriott Bonvoy bonus factors after spending $8,000 on eligible purchases within the first six months of card membership.

- Marriott Bonvoy Daring® Credit score Card: Earn 60,000 bonus factors plus one free evening award after spending $2,000 on purchases within the first three months from account opening. The free evening is valued at 50,000 factors. Sure resorts have resort charges.

In accordance with TPG’s February 2025 valuations, Marriott Bonvoy factors are price 0.85 cents every. Earlier than transferring factors, evaluate our checks of Marriott switch instances, since some airways take a number of days (and even weeks) to obtain the factors.

Associated: Marriott Bonvoy program: How you can redeem factors for lodge stays, airfare and extra

Do you have to switch factors?

We solely suggest transferring factors or miles when you have a short-term plan to make use of them. Many applications have applied devaluations over the previous few years, so speculative transfers might show a shedding proposition.

Transfers are irreversible, and you do not need to be caught with 1000’s of factors or miles in a program you’ve gotten little use for.

If you do not have a selected redemption in thoughts however nonetheless need to earn factors or miles, you are doubtless higher off incomes rewards via card welcome bonuses and on a regular basis spending.

And we at all times suggest you guarantee award availability earlier than transferring your rewards.

Backside line

When a program with a transferable foreign money provides a switch bonus, it is necessary to run the numbers to find out whether or not it’s worthwhile.

Usually, you will not need to switch your factors or miles with no particular redemption in thoughts. In spite of everything, a big a part of the worth of transferable factors and miles comes from their flexibility — which you will hand over once you convert them to a associate’s foreign money. Nonetheless, a switch bonus can assist you get extra worth out of your factors and miles for those who use a associate program incessantly or plan to redeem quickly.

Associated studying: